Ready to build a better future? Apply now.

Personal loansImproving your credit score: Length of credit history

The length of your credit history affects about 15% of your FICO® credit score.*

The longer you’ve been building your credit history, the better it looks to the credit bureaus. They assume that a person with 15 years of recorded on-time payments is more likely to continue making on-time payments than a person with 1 year of on-time payments.

Here’s an idea for improving your length of credit history, without having to wait several years.

Don’t open several new accounts in a short time period. Your FICO® credit score considers the average age of your accounts. If you open a number of accounts at the same time, your average age will be younger.

What is a FICO® credit score and what goes into it?

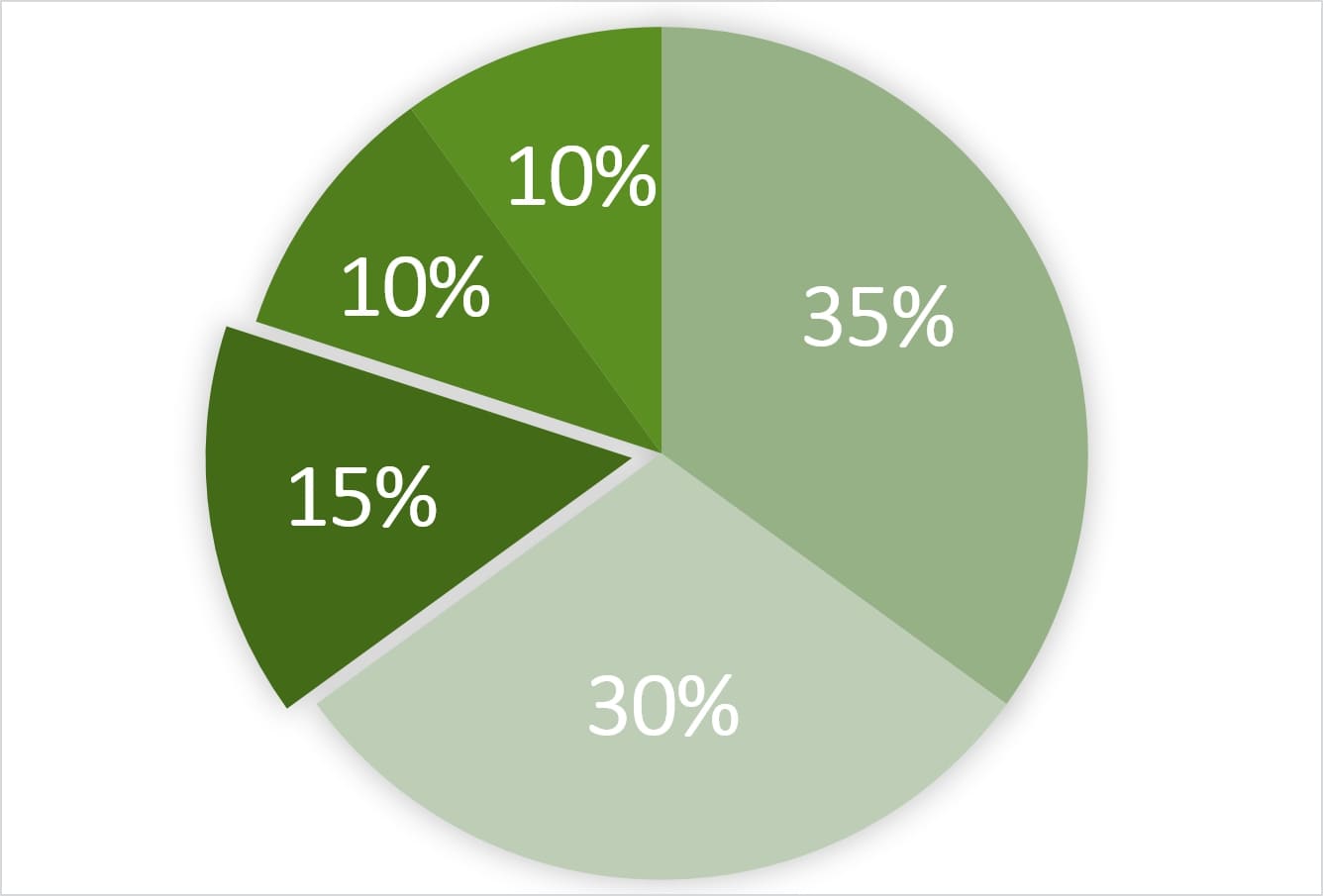

A credit score is a calculation that indicates how likely you are to pay back debts. The FICO® score is the most common type, and is a three digit number (between 300 and 850), where a higher score means more likely to pay back a debt. It is calculated by a math formula that takes into account the following factors:

- Payment history (35%)

- Amount owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

*FICO® is solely responsible for its credit score calculation. Information contained on the FICO® website is its own content and is not managed, sponsored or endorsed by Oportun. Oportun does not require a credit score to qualify for its products nor does Oportun rely on this score.

The information in this site, including any third-party content and opinions, is for educational purposes only and should not be relied upon as legal, tax, or financial advice or to indicate the availability or suitability of any Oportun product or service to your unique circumstances. Contact your independent financial advisor for advice on your personal situation.

Credit cards through Oportun subject to credit approval. Terms may vary and are subject to change. The Oportun® Visa® Credit Card is issued by WebBank. The Oportun Credit Card is open to all consumers, except for residents in CO, DC, IA, MD, WI, and WV. See the Oportun Cardholder Agreement or the Oportun Cash Back Cardholder Agreement for details, including applicable fees.

Personal loans through Oportun subject to credit approval. Terms may vary by applicant and state and are subject to change. If you refinance, you may pay interest over a longer period of time or at a higher rate and the overall cost of your loan may be higher. Loans in NM and WI are originated by Oportun, Inc. California loans made pursuant to a California Financing Law license. NV loans originated by Oportun, LLC. In AL, AK, AR, AZ, CA, DE, FL, GA, HI, ID, IL, IN, KS, KY, LA, MI, MN, MO, MS, MT, NC, ND, NE, NH, NJ, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, VT, WA and WY loans are originated by Pathward®, N.A.. Terms, conditions, and state restrictions apply.

You might also like